Predictive CLV uses AI to forecast customer value, optimize marketing, and boost retention, enabling personalized, data-driven growth.

In today’s competitive landscape, understanding and optimizing Customer Lifetime Value (CLV) is paramount to sustainable growth. Predictive analytics empowers marketers to forecast future behavior, tailor personalized campaigns, and allocate resources where they matter most. In this comprehensive guide, we’ll walk through the concepts, tools, and best practices you need to boost CLV with data-driven strategies.

Why Customer Lifetime Value Matters

Customer Lifetime Value is more than just a metric—it’s a lens through which businesses can evaluate long-term profitability, retention efforts, and acquisition strategies. By focusing on CLV, you can:

- Prioritize high-value customer segments

- Optimize marketing spend for durable ROI

- Enhance customer loyalty and reduce churn

Understanding CLV in the context of your overall strategy is crucial. For a deeper dive, check out our guide on how to build a data-driven marketing strategy, which shows how insights like CLV can guide campaign planning and resource allocation.

The Role of Predictive Analytics

Predictive analytics applies statistical models and machine learning algorithms to historical data, enabling marketers to anticipate outcomes such as repeat purchases, churn risk, and upsell opportunities. When applied to CLV, it helps you identify which customers are likely to drive the most revenue—and how to engage them effectively.

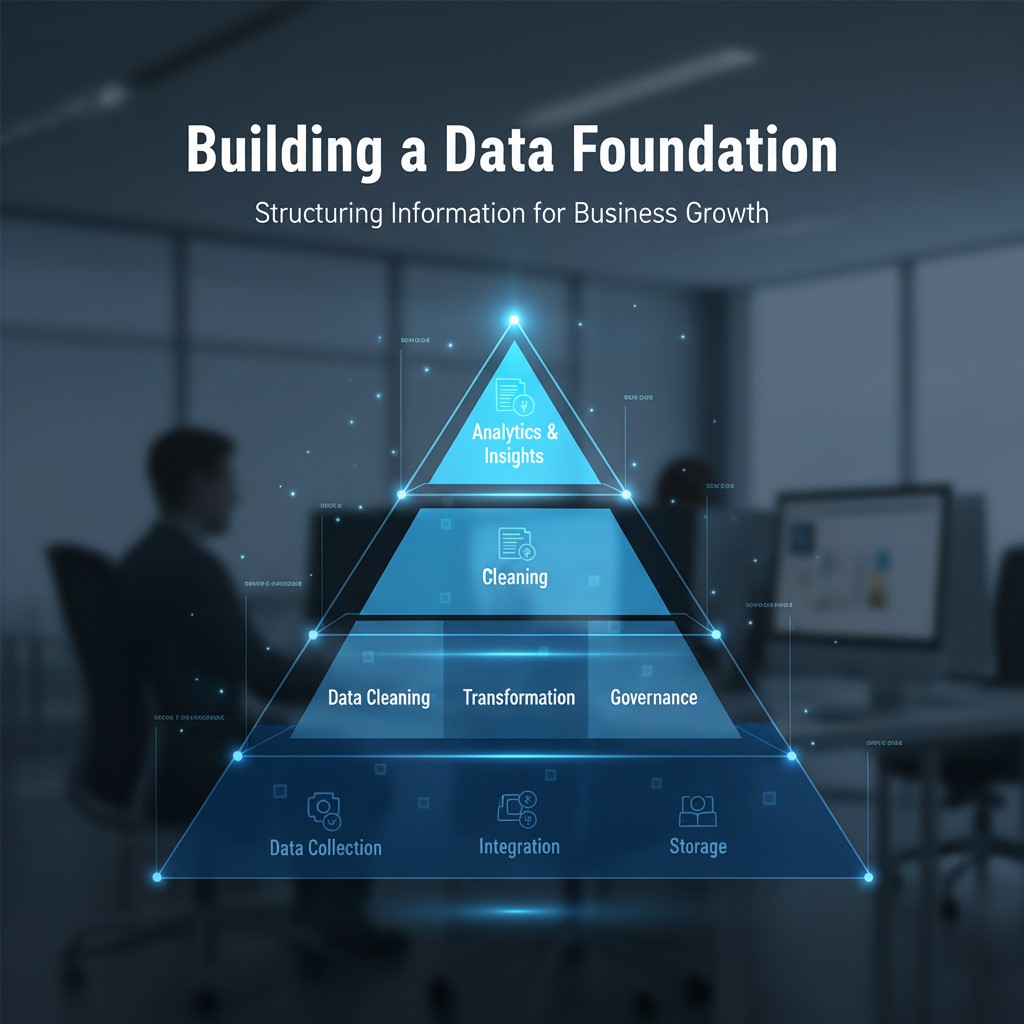

Building a Data Foundation

Before diving into modeling, ensure you have a robust data infrastructure:

- Centralized Customer Database: Aggregate touchpoints—website visits, email interactions, transaction history—into a single customer profile.

- Data Quality Controls: Implement validation rules, deduplication, and normalization to maintain accuracy.

- Real-Time & Batch Processing: Balance streaming data (e.g., behavioral triggers) with batch ETL for historical trends.

To make the most of these analytics, integrating personalized data-driven marketing can help you deliver campaigns that resonate with high-value customers based on predictive insights.

Choosing the Right Predictive Model

Several modeling techniques can forecast CLV. Your choice depends on data volume, business complexity, and required precision:

- Regression Analysis: Useful for linear relationships between features (e.g., frequency, recency) and spend.

- Cohort Analysis with Time Series: Tracks purchase behavior over time by cohort segments.

- Machine Learning Models: Random forests, gradient boosting, and neural networks can capture complex non-linear patterns.

- Pareto/NBD & Gamma-Gamma Models: Specialized for estimating purchase frequency and monetary value in e-commerce.

Key Predictive Features for CLV

Selecting relevant features is critical. Common predictors include:

- Recency, Frequency, Monetary (RFM): Classic indicators of customer engagement.

- Product Preferences: Category and SKU-level purchase patterns.

- Channel Interactions: Email open rates, click-throughs, ad engagements.

- Customer Support Touchpoints: Inquiries, returns, and satisfaction scores.

- Demographics & Psychographics: Age, location, interests, and digital behavior.

Training and Validating Your Model

Follow these steps for model development:

- Data Split: Divide data into training (70–80%) and validation (20–30%) sets.

- Feature Engineering: Create derived variables (e.g., average order value trends).

- Hyperparameter Tuning: Optimize tree depth, learning rate, and regularization in ML models.

- Cross-Validation: Use k-fold or time-based CV to ensure generalization.

- Evaluation Metrics: Monitor RMSE, MAE for regression; AUC-ROC for classification of high vs. low CLV.

Integrating Predictions into Marketing Workflows

Once your model is live, embed CLV scores across platforms to drive decisions:

- Personalized Campaigns: Tailor email offers to high-CLV customers with loyalty rewards.

- Ad Spend Allocation: Bid more aggressively on lookalike audiences matching top CLV profiles.

- Retention Tactics: Implement win-back sequences for customers trending toward churn.

- Product Bundling: Recommend cross-sell/up-sell combos based on predicted future value.

To ensure campaigns reach the right audience, leveraging data-driven influencer marketing can help extend the reach of high-CLV campaigns while maximizing ROI.

Real-World Case Study

E-Commerce Retailer X leveraged a gradient boosting model on three years of purchase data. By segmenting customers into quintiles of predicted CLV, they:

- Increased targeted email open rates by 25% for the top quintile

- Reduced marketing spend on low-CLV segments by 18% without impacting revenue

- Boosted repeat purchase rates by 12% through personalized loyalty offers

Over six months, the approach contributed to a 20% lift in overall CLV, translating into a 15% growth in net revenue.

Monitoring and Continuous Improvement

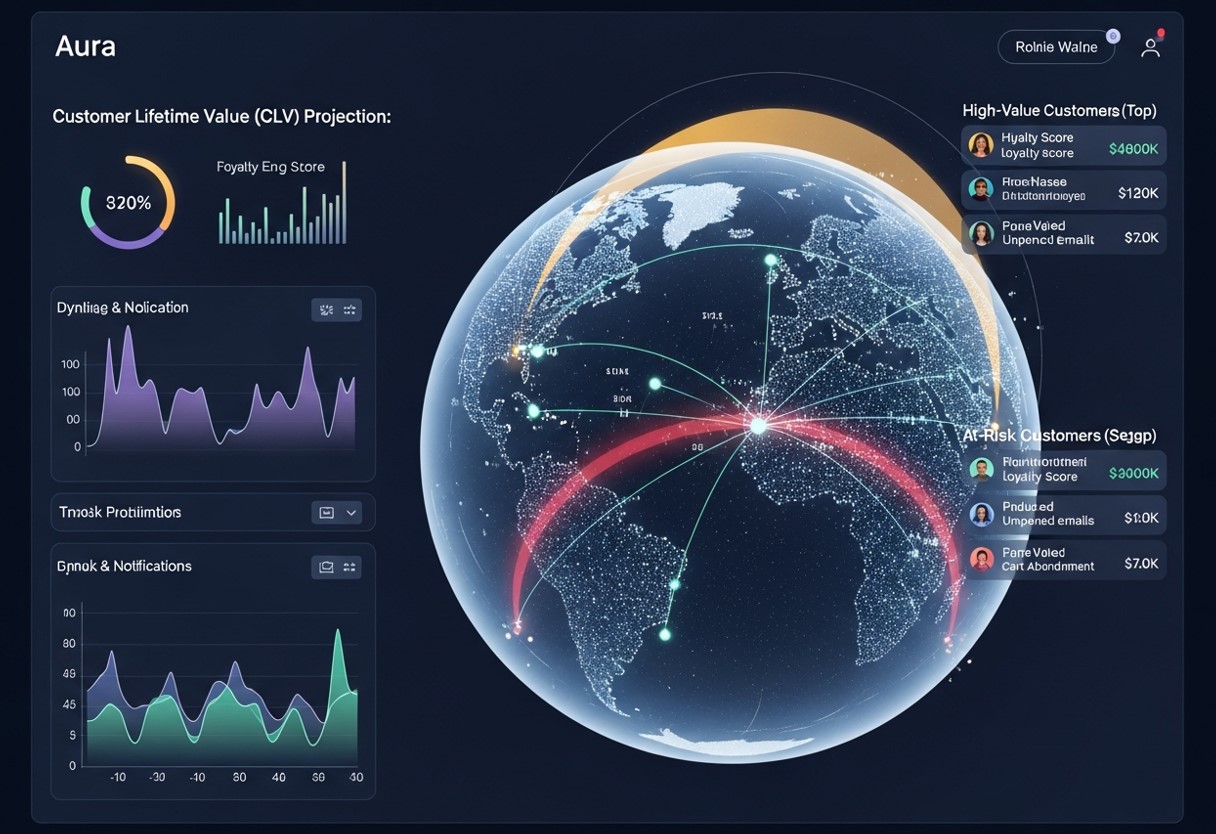

Predictive models degrade over time if not maintained. Establish an ongoing process for:

- Data Drift Detection: Alerts when input feature distributions change significantly.

- Model Retraining Cadence: Schedule quarterly or monthly retraining with fresh data.

- Performance Dashboards: Track prediction accuracy and business KPIs like average CLV.

- A/B Testing: Validate that activation campaigns driven by CLV scores outperform control groups.

Ethical Considerations and Data Privacy

While predictive analytics offers immense value, it also raises ethical and privacy concerns. Best practices include:

- Consent Management: Ensure customers opt in for data usage beyond basic transactions.

- Anonymization & Encryption: Protect personally identifiable information (PII) in storage and transit.

- Fairness Audits: Identify and correct bias that may exclude or disadvantage certain segments.

- Transparency: Communicate how data is used to drive personalization and pricing.

Future Trends in Predictive CLV

Emerging technologies are set to further refine CLV forecasts:

- AI-Driven Feature Discovery: Automated machine learning (AutoML) tools that surface novel predictors.

- Real-Time Streaming Insights: Instant CLV recalculation as customers interact across channels.

- Blockchain for Data Integrity: Secure, auditable trails of customer consent and data provenance.

- Advanced Customer Graphs: Network analysis linking referrals, social influence, and purchase behavior.

Segmenting Customers Beyond CLV Quintiles

While segmenting customers into CLV quintiles is a powerful start, diving deeper into behavioral and psychographic nuances can unlock even more tailored strategies. High-CLV customers may not all behave the same way—some may be loyal but price-sensitive, while others may be early adopters willing to try premium offerings. By layering segments with product preferences, engagement channels, and lifecycle stage, marketers can craft campaigns that resonate on an individual level.

For instance, combining CLV predictions with churn risk creates a priority matrix: customers with high predicted value but moderate risk of churn become the most critical group for retention efforts. Conversely, low-CLV, low-risk customers may receive automated, low-touch engagement to maintain baseline satisfaction without overspending. This multi-dimensional approach ensures marketing resources are used efficiently while creating highly relevant experiences for different audiences.

Incorporating Behavioral Triggers into Predictive CLV Strategies

Predictive CLV models are not just for retrospective insights—they are most effective when integrated into real-time marketing workflows. Behavioral triggers allow you to act immediately on signals that indicate a customer is likely to purchase, churn, or engage in upsell opportunities.

For example, a customer who browses a premium product repeatedly without purchasing may be nudged with a personalized discount or bundled offer. Conversely, a high-CLV customer who has slowed their activity might receive a loyalty reward or early access to a new collection. By combining predictive CLV scores with behavioral triggers, marketing shifts from a static segmentation exercise to a dynamic, anticipatory strategy that actively reduces churn and maximizes lifetime value.

For teams managing data-heavy customer interactions, automating data entry with JavaScript can help integrate real-time behavioral triggers seamlessly into marketing workflows.

Optimizing Resource Allocation Across Channels

Understanding predicted CLV is invaluable for channel-level decision making. Marketers can allocate budget, time, and creative effort based on expected returns rather than intuition. High-value segments may warrant intensive attention via personalized email campaigns, retargeting ads, and dedicated customer success support. Lower-value segments may benefit from automated workflows and lower-cost acquisition strategies.

This resource alignment extends to the content itself. For top-CLV customers, brands can invest in premium experiences—interactive product demos, exclusive webinars, or concierge services. For mid-CLV customers, nurture campaigns emphasizing product benefits and cross-sell opportunities may suffice. By strategically deploying efforts where they are likely to yield the highest return, predictive CLV helps optimize both spend and human capital.

Leveraging Cross-Channel Attribution with CLV

Predictive CLV is most potent when combined with cross-channel attribution. Understanding which touchpoints contribute to high-value customers enables marketers to double down on strategies that actually drive long-term revenue. Attribution models—whether first-touch, last-touch, or multi-touch—should be enriched with CLV insights to prioritize channels that produce loyal, high-spending customers, not just immediate conversions.

For instance, a paid social campaign may generate fewer total conversions than email marketing, but if those conversions include a disproportionate share of high-CLV customers, the ROI of the social channel could be significantly higher. Using predictive CLV as a lens transforms your understanding of marketing performance, allowing you to optimize campaigns for value rather than volume.

Customer Experience as a CLV Multiplier

Even the most sophisticated predictive models cannot compensate for poor experiences. CLV is inherently linked to satisfaction, trust, and convenience. Brands that actively remove friction, deliver personalized interactions, and provide consistent service amplify the predictions of their models. Positive experiences not only reinforce repeat purchase behavior but also generate advocacy, creating new high-value customers through referrals.

In practice, this means using predictive insights to proactively enhance experiences. A high-CLV customer with a pending issue should receive immediate, priority support. Personalized onboarding journeys can be optimized for customers predicted to engage heavily with a product, and loyalty programs can reward behaviors most correlated with increased lifetime value. In essence, predictive CLV models guide investments in experience that maximize both retention and advocacy.

Advanced Ethical and Privacy Considerations

As predictive CLV strategies become more sophisticated, the ethical handling of customer data grows increasingly critical. Beyond consent and anonymization, marketers must consider fairness in predictive outputs. Algorithms trained on historical data can unintentionally reinforce biases—overlooking certain demographics or penalizing customers who historically engage less due to systemic barriers.

Routine fairness audits, transparency reports, and explainable AI techniques ensure predictions remain equitable and defensible. Brands that are proactive in ethical data management not only avoid reputational risk but also enhance customer trust, which itself contributes to higher CLV through loyalty and retention.

Conclusion

Predictive analytics for Customer Lifetime Value is a game-changer in data-driven marketing. By establishing a solid data foundation, selecting the right models, and embedding predictions into everyday workflows, organizations can prioritize high-value customers, optimize acquisition costs, and drive sustainable growth. Implement continuous monitoring and stay attuned to ethical considerations to keep your CLV strategy both effective and responsible. Start small, iterate fast, and watch how predictive insights transform your marketing ROI.

Integrating predictive CLV insights with a broader data-driven marketing approach ensures marketing resources are focused on creating maximum impact for high-value segments, from acquisition to retention.

Frequently Asked Questions (FAQ)

How does predictive CLV differ from traditional CLV calculation?

Traditional CLV often relies on simple historical averages or RFM metrics, providing a static snapshot of value. Predictive CLV leverages machine learning and statistical models to forecast future behavior, enabling marketers to anticipate trends, identify high-value customers early, and tailor interventions proactively. Unlike traditional CLV, it can account for changing behavior patterns and complex interactions across channels.

Is predictive CLV only relevant for e-commerce?

No. While e-commerce provides abundant transaction data, predictive CLV is valuable across industries—from subscription services and SaaS platforms to retail banking and travel. Any business with recurring interactions can benefit from forecasting lifetime value to guide marketing, retention, and product decisions. The key is having sufficient historical data to train reliable models.

How can small businesses implement predictive CLV without large datasets?

Small businesses can start with simpler approaches, such as RFM analysis combined with basic regression or decision trees. Even limited transaction history can reveal meaningful trends, and incremental data collection can gradually improve model sophistication. The important principle is to act on insights early, iteratively improving predictions as data grows.

Can predictive CLV improve customer retention?

Absolutely. By identifying which customers are likely to churn or reduce engagement, predictive CLV allows for timely interventions—personalized offers, loyalty rewards, or proactive support. Retention efforts guided by predictive insights are often more cost-effective than blanket campaigns, focusing attention on those who can deliver the most lifetime value.

How often should predictive CLV models be updated?

Frequency depends on data velocity and business dynamics. High-transaction, fast-moving industries may require monthly updates, while slower-moving businesses can retrain quarterly. Monitoring for data drift, sudden behavior changes, or campaign shifts ensures models remain accurate. Continuous monitoring and retraining are essential to prevent degradation and preserve predictive power.

What mistakes should marketers avoid when using predictive CLV?

Common pitfalls include over-reliance on CLV scores without context, ignoring the qualitative factors behind customer behavior, and assuming predictions are guarantees rather than probabilities. Additionally, failure to align predictive insights with business processes—such as marketing activation or support workflows—can render CLV insights underutilized. Integration, testing, and human judgment remain crucial.

Can predictive CLV help in customer acquisition strategy?

Yes, predictive CLV can transform acquisition strategy by identifying the characteristics of your most valuable customers. By analyzing patterns among high-CLV segments, marketers can build lookalike audiences, target similar demographics, and refine messaging to attract users most likely to deliver long-term value. This approach ensures that acquisition spend focuses not just on volume, but on quality, maximizing ROI over time. In effect, predictive CLV turns historical insights into forward-looking growth opportunities.

How do I balance short-term revenue with long-term CLV?

Short-term promotions often boost immediate sales but can inadvertently reduce long-term value if they erode margins or attract bargain-hunters who don’t stay loyal. Predictive CLV helps strike a balance by quantifying the long-term worth of different customer segments. This allows marketers to allocate promotional budgets strategically—offering high-value customers personalized incentives while minimizing unnecessary discounts to low-CLV segments. It’s a method of aligning immediate revenue goals with sustainable growth.

Leave a Reply